tax return news australia

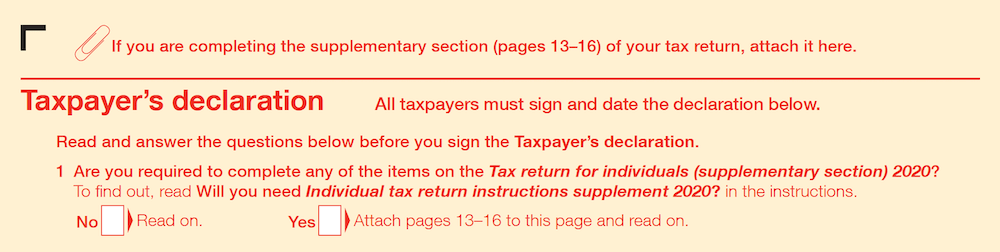

Assistance to ensure income is properly taxed and not taxed twice. You need to submit the tax return to the Australian Tax office by 31st.

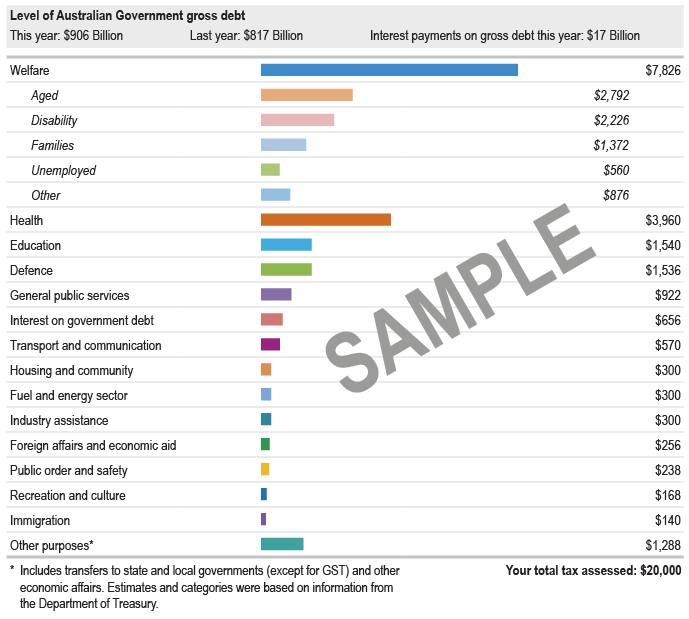

Tax Receipt Australian Taxation Office

Tax returns should be submitted or engaged with a tax agent by October 31.

. Help preparing Australian tax returns including advice on tax deductions to reduce your tax liability. If you receive income from an Australian super income stream you may be entitled to a tax offset equal to. This includes a consideration of provisions of the Tax Treaty between Australia and New Zealand.

Australian super income stream tax offset. You are an Australian resident and your taxable income was above the tax-free threshold. Whenever possible tax returns are submitted to the Australian Taxation Office electronically.

From July 1 to June 30 of the tax year you owe taxes on your income. Federal budget 500pm. 15 of the taxed element or.

Australian individual taxpayers can file their return online with the ATOs myTax software by ordering a printed copy of the tax return form or with the assistance of a tax agent. In order to lodge a tax return you must include how much money you earn income and any expenses you can claim. Those earning between 37000 and 48000 will receive 255.

Interest on early payments and overpayments of tax 2012-13. Duty is calculated on the type of alcohol the volume contained per bottle the alcohol per bottle and the value per bottle. Todays Tax news live updates all the latest breaking stories from 7NEWS.

Key events for Australian shareholders 2012-13. Tax return due date 2022 australia. You are leaving Australia permanently or for more than one tax year.

Work out if you need to lodge a tax return. From tax cuts to tax returns and every how to you need read all the latest tax advice news and updates. Meanwhile the LMITO extension means those earning less than 37000 a year will receive an extra 255 in their tax returns this year.

Stay up to date with all of the breaking Tax headlines. One of the main considerations is the time frame. Here are answers to tax questions to help you file your return claim the biggest tax breaks and avoid scams.

10 of the untaxed. Tax return for individuals supplementary section 2012-13. You are a non-resident and earned over 1 in Australia during the tax year.

If you have no tax payable the beneficiary tax offset is not available to be used. Finance Finance News Tax return windfall. Best Shopping Deals.

2022 Guide to Tax Deductions in Australia. Your Returns Will Be Filed By April 18 2022. When Can You Claim Tax Back In Australia.

The income Tax return filing deadline for the assessment year 2020-21 has been extended for the third time to January 10 2021 Dec 30 2020 0648 PM IST ITR filing Government extends income tax. Tax return deadlines vary depending on whether youre using your own tax software or whether youre filing with an accounting firm. Around 10 million Australians will pocket an extra 420 when they lodge their tax returns after July 1 under a plan to increase tax relief for low and middle income earners.

The tax return covers the financial year from 1st July of a year to 30 June of the following year When you file in your tax return you declare all your earnings and claim for expenses that are allowed as deductions. Australian tax returns for the tax year beginning 1 July and ending 30 June of the following year are generally due on 31 October after the end of the tax year. Customs duties plus goods and services tax GST will apply to alcohol imported into Australia.

Tax returns are always worth doing if you are a little or much less than last year. In this austrlia tax guide we examine the different tax deductions and expenses which should be accounted for when completing a tax return to ensure you pay the right amount of tax and claim back YOUR money for. The deadline for your tax return is 12 months after the end of the accounting period it covers.

Tax Returns Survey. To claim the offset you must declare the payment you receive at the correct item on your tax return. You must file an Australian tax return if.

7NEWS brings you the latest Tax news from Australia and around the world. Listing of individual tax return instructions by year. Tax Return Due Date 2022 Australia.

IR-2022-66 March 25 2022 Unclaimed income tax refunds totaling almost 15 billion may be waiting for an estimated 15 million taxpayers who did not file a 2018 Form 1040 federal income tax return but people must act before the April tax deadline according to. Ten percent 10 GST is then added to the duty calculated. Separation of new News Corporation from Twenty-First Century Fox Inc.

Your Personal Tax Return Includes Your Business Or Rental Activity Schedule C AndOr E Businesses And Complete Data Is Received By March 15 2022. Australia to be cashless in a decade experts predict Australia will become fully cashless by 2031 as Covid-19 hastens the death of physical currency according to most experts surveyed by Finder. We use information from your tax return such as your income and the amount of tax you have paid to work out if you need to pay extra tax or if you will get money back a tax refund.

Tax was deducted from any payments like your wages that you received during the tax year. Tax Return 300000 Aussies facing ATO audit The ATO has warned 300000 Aussies that tax time isnt a game of Monopoly where you can roll the dice and avoid reporting income or luxury goods. However if these dates fall on a saturday sunday or legal holiday in any given year the payments are due the next business day.

As stipulated by the Australian Taxation Office ATO if you transferring an overseas pension like a UK pension for example to an Australian compliant super fund and that transfer was to occur within 6 months of becoming a resident of Australia or within 6 months of terminating your foreign. DUTIABLE AND RESTRICTED ITEMS. You are leaving Australia.

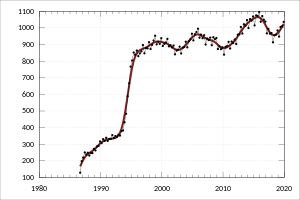

Australians receive 53 billion in record-breaking time 1000pm Jul 29 2021 Updated. What is the deadline for tax return filing. Until 2011 the Australian Taxation Office ATO.

20210913 if your vat period has a 31 may 2022 end date your first vat quarter. 2022 income tax return due for people and organisations who dont have a tax agent or extension of time. Your income in Australia between 1 July 2020 and 30 June 2021 needs to be reported to the IRS.

One of Australias largest banks has been caught charging. Then you get your tax refund if any.

Etax Australian Tax Return Tax Returns Are Easy At Etax Com Au

Tax Brackets Australia See The Individual Income Tax Tables Here

What Are The Basic Tax Returns In Australia Income Tax Return Tax Refund Tax Return

Income Tax Exempt Organisations Australian Taxation Office

2020 21 Tax Cuts Everything You Need To Know Etax Online Tax

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Online Tax Return Australia Lodge Tax Return Tax Refund Irs Taxes Tax Season

Etax Australian Tax Return Tax Returns Are Easy At Etax Com Au

Australian Tax Office Has Called Cryptocurrency Investors To Send Reports About Their Crypto Earnings Major Simplify Cryptocurrency News Blockchain Technology

Australian Income Tax Brackets And Rates For 2021 And 2022

Taxation The Star Entertainment Group

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Taxation In Australia Wikipedia

Taxation In Australia Wikipedia

Tax Filing Season 2022 What To Do Before January 24 Marca

Top Mistakes To Avoid While Filing Income Tax Return Itr For Ay 2021 22 This Month The Financial Express

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Haven T Lodged Your Tax Return Yet October 31st Is Usually The Last Date Of Lodging Your Tax Return By Your International Students Tax Return Student