ebike tax credit income limit

Individuals who make 75000 or less qualify for the maximum credit of up to 900. Cars need to be under 55000.

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

250000 for single people.

. This means that the federal government has not finalized it. The E-BIKE Act creates a consumer tax credit that will cover 30 of the cost of the e-bike up to a 1500 credit. 500000 for married couples.

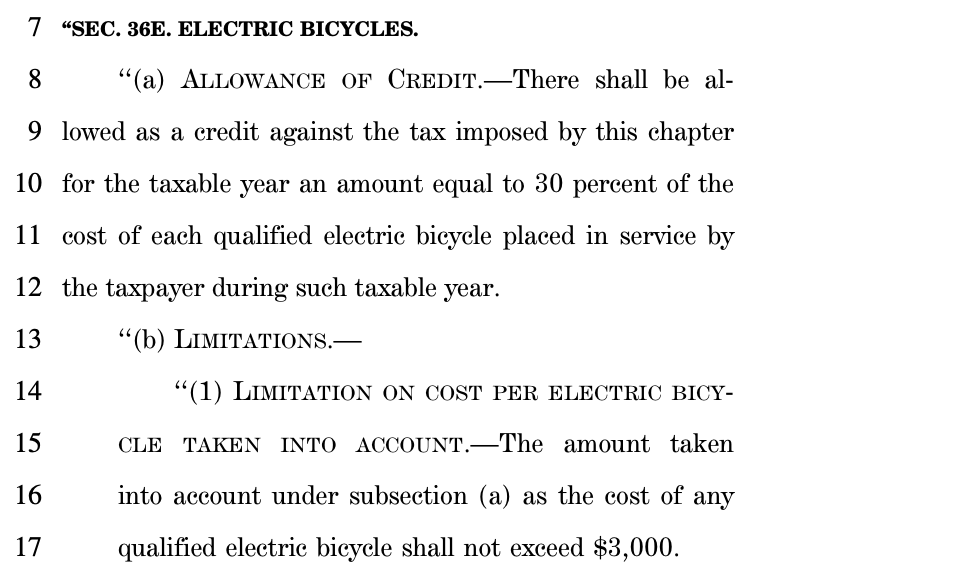

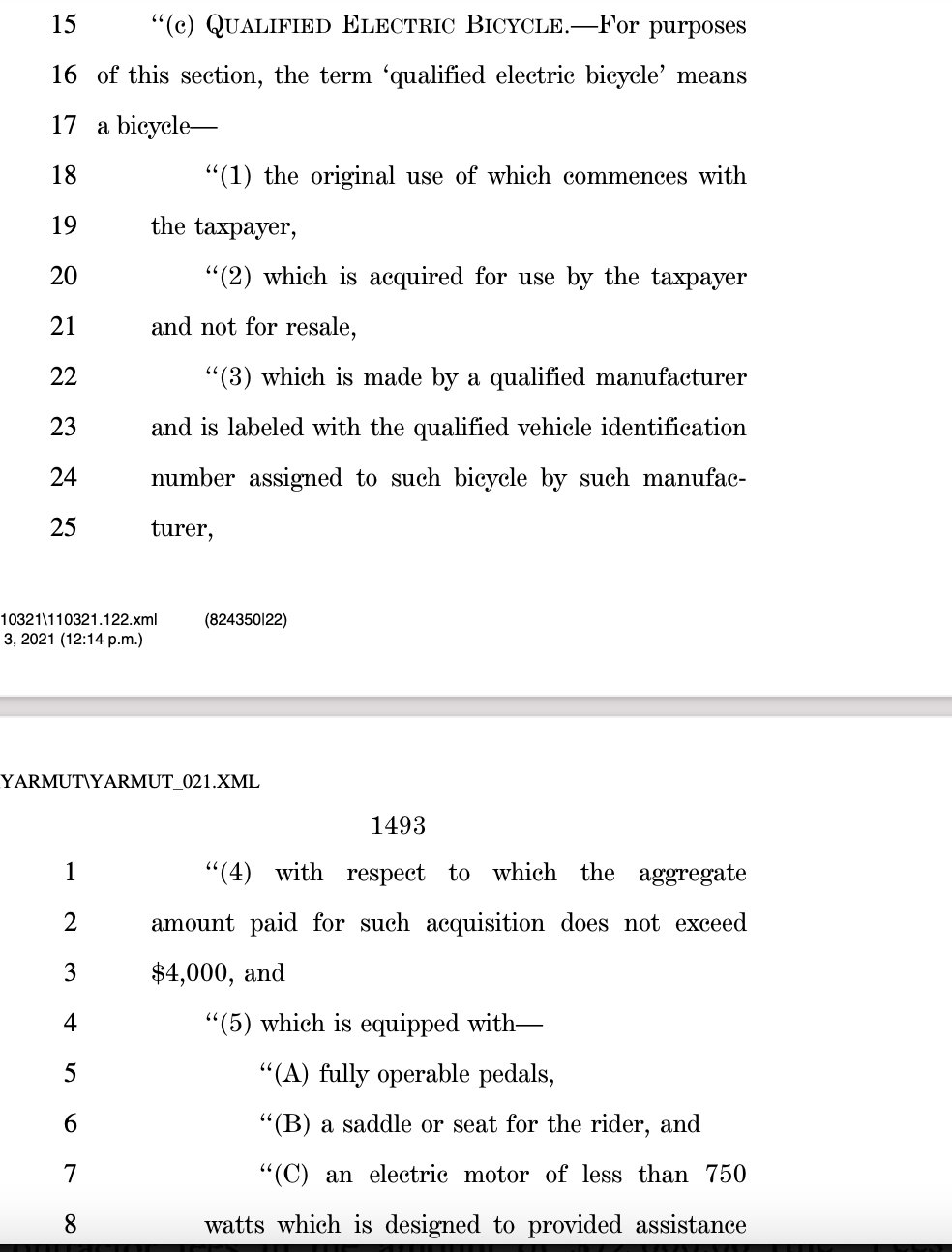

The Electric Bicycle Incentive Kickstart for the Environment Act creates a consumer tax credit that can cover up to 30 of the cost of buying an eBike. The e-bike tax credit would phase out at 75000 adjusted gross income for individual taxpayers 112500 for heads of household and 150000 for married filing jointly. The proposed tax credit would not apply to any e-bike worth more than 8000.

Californias E-Bike Affordability Program provides 10 million in subsidies to help people buy e-bikes. Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax credit on each. The proposed eligibility requirements for the EV tax credit are simple.

The E-Bike Act. The credits also phase out according to household income. The halving of the incentive is sadly not the only revision reports Electrek.

Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. There now also exists an income based phase out of the credit applicable to those earning over 70000 or 112500 for heads of household and 150000 if the submission is made on behalf of married couples. Individuals may claim the credit for one electric bicycle per year max 750 credit or two bikes for joint filers max 1500 credit.

The full 12500 would be earned in increments. For those who make less than 75000 as an individual or 150000 as joint. Theres also an income limit for taxpayers to receive the credit.

However the bill is nothing that is set in stone and is a proposed one. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. The program is scheduled to begin in July of 2022.

The maximum annual reimbursement an employee could receive tax-free would jump from 240 to over 600. About Form 4562 Depreciation and Amortization. If you wish to splash 10000 dollars on an E-bike then you may not even need a tax deduction.

According to the federal standards the law only applies to bicycles that are 750 watts. CalBike is working with CARB to develop guidelines for who will be eligible the size of the grants and the equitable distribution of the funds. Non-cars vans trucks SUVs need to be under 80000 to be eligible for the credit.

As it stands the bill provides a credit of 30 for up to 3000 spent on a new e-bike excluding bikes that cost more than 4000. The tax credit is only authorized until 2026. The new proposal limits the full EV tax credit for individual taxpayers reporting adjusted gross incomes of 250000 or 500000 for joint filers down from 400000 for individual filers and.

The credit begins to phase out above those income levels at a rate of 200 per 1000 of additional income. It only applies to new e-bikes that cost less than 8000 and is fully refundable allowing lower-income workers to claim the credit. How much tax credit would I get from the E-bike tax credit.

Income Tax Return for an S Corporation. The credit would begin phasing out for taxpayers earning over 75000 though that figure increases to 112500 for heads of household and. The credit begins to phase out above those income levels at a rate of 200 per 1000 of additional income.

1 D OLLAR LIMITATIONIn the case of any taxpayer for any taxable year the credit allowed under subsection a shall not exceed the excess if any of A 1500 twice such amount in the case of a joint return reduced by B the aggregate credits allowed to the taxpayer under subsection a for the 2 preceding taxable years. The credit would offer certain citizens a 30 percent refundable tax credit if they purchased an e-bike under 4000. Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles.

Supporters who have followed the E-BIKE Act since it was introduced in February will notice that these differences shrink the. The E-BIKE Act creates a consumer tax credit that will cover 30 of the cost of the e-bike up to a 1500 credit. 7500 for the electric vehicle an additional 2500 for vehicles assembled within the United States and.

We expect this program to help 10000. It would also begin to phase out for e-bike buyers who make more than 75000 annually or married couples who earn over 150000 per year. Individuals who make 75000 or less qualify for the maximum credit of up to 900.

The amount of the credit will vary depending on the capacity of the battery used to power the car. The credit has a limit of 1500. The credit phases out starting at 75000 of modified adjusted gross income 112500 for heads of household and 150000 for married filing jointly at a rate of 200 per 1000 of additional.

Before you rush out to pick up your new e-bike however understand this. Tucked among its more than 2000 pages is a tax credit of up to 900 for e-bikes.

David Zipper On Twitter Notably Individuals Must Make Less Than 75k To Claim The Full 900 E Bike Credit By My Math You Can T Get Anything For It If You Make Over 83k

:max_bytes(150000):strip_icc()/comparison-44a635d15c28423a9840966341963b2b.jpg)

E Bike Incentives In Tax Bill Are Laughable Compared To Those For Electric Cars

Electric Bikes Sparking Increased Interest Ebikest

David Zipper On Twitter Notably Individuals Must Make Less Than 75k To Claim The Full 900 E Bike Credit By My Math You Can T Get Anything For It If You Make Over 83k

Tern S New E Bike Priced To Maximize Proposed Federal Tax Credit Bicycle Retailer And Industry News

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

Tern S New E Bike Priced To Maximize Proposed Federal Tax Credit Bicycle Retailer And Industry News

Understanding The Electric Bike Tax Credit

E Bikes Could Get A Major 30 Tax Credit Serial 1 Forum

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

/GettyImages-1139717357-20236dae817d4164bef9d05504059bc7.jpg)

E Bike Incentives In Tax Bill Are Laughable Compared To Those For Electric Cars

David Zipper On Twitter Notably Individuals Must Make Less Than 75k To Claim The Full 900 E Bike Credit By My Math You Can T Get Anything For It If You Make Over 83k

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

Tax Rebates For Ebikes In The Build Back Better Bill R Ebikes

Tax Credits Jump To 1 500 For E Bikes 7 500 For Electric Motorcycles In Build Back Better Act R Ebikes

Biden S Compromise Legislation Platform Returns E Bike Tax Credit To Original Rate Bicycle Retailer And Industry News

30 Tax Credit For Ebike Has Now Been Proposed In Us Congress Write Call Pester Your Reps R Ebikes